Is Type 2 Diabetes Considered a Disability? Exploring Rights, Benefits, and Living Well

Discover how type 2 diabetes can qualify as a disability, what legal rights and workplace protections exist, and how to pursue benefits and accommodations.

Is Type 2 Diabetes Considered a Disability?

If you are living with type 2 diabetes, you may wonder whether your condition is officially considered a disability and what that means for your legal rights, workplace accommodations, and access to benefits. The answer is nuanced, depending on how diabetes affects your daily life and employability. This article explores the legal classification of type 2 diabetes, disability benefits, workplace rights, and practical steps for managing work and health.

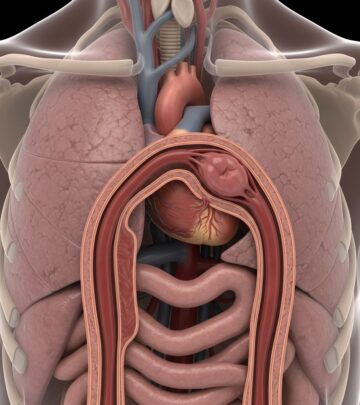

Understanding Type 2 Diabetes and Its Impact

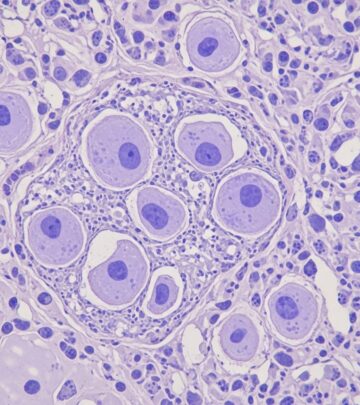

Type 2 diabetes is a chronic metabolic disorder that affects how your body processes glucose (sugar). High blood sugar levels over time can lead to significant health complications, ranging from cardiovascular disease to nerve and vision problems. While many people manage the condition with lifestyle changes and medication, some develop severe complications that limit their ability to work or perform daily tasks.

- Type 2 diabetes is primarily caused by insulin resistance and impaired insulin production.

- Long-term complications can include nerve damage (neuropathy), kidney disease (nephropathy), eye problems (retinopathy), and circulation issues.

- These complications can sometimes interfere with one’s capacity to maintain employment or participate in major life activities.

Is Type 2 Diabetes a Legally Recognized Disability?

Whether type 2 diabetes is considered a disability depends on specific legal standards and how diabetes affects your life. In the United States, several laws address what constitutes a disability, most notably the Americans with Disabilities Act (ADA) and the Social Security Administration (SSA) guidelines.

The Americans with Disabilities Act (ADA)

The ADA defines a disability as a physical or mental impairment that substantially limits one or more major life activities. Under this law:

- Both type 1 and type 2 diabetes are recognized as disabilities if they limit daily activities such as eating, walking, or working.

- This recognition provides legal protection against discrimination in employment, public services, and other areas.

- You do not have to disclose your diabetes diagnosis to an employer before being hired, but you are protected if you choose to do so.

Bottom line: The ADA generally protects people with diabetes from discrimination and ensures reasonable accommodations at work and in public services.

The Social Security Administration (SSA) and Disability Benefits

The question of whether type 2 diabetes qualifies for government disability benefits is more complex. The SSA no longer includes type 2 diabetes as a separate disability listing for automatic qualification. Instead:

- Simply having a diagnosis of type 2 diabetes does not automatically qualify you for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) benefits.

- If you develop serious complications that meet or equal another listed impairment, such as severe neuropathy, kidney failure, or vision loss, you may qualify for benefits.

- To be eligible, you must show that your condition substantially limits your ability to work and perform daily activities, even after following prescribed treatment.

How Type 2 Diabetes May Limit Major Life Activities

Whether type 2 diabetes is disabling often depends on how it limits your daily functioning. Potential limitations include:

- Frequent or severe blood sugar swings that require daytime medical management

- Fatigue, pain, or neuropathy interfering with mobility or basic tasks

- Long absences from work for medical appointments or hospitalizations

- Visual impairment from diabetic retinopathy

- High risk of life-threatening complications, such as hypoglycemic episodes

The more diabetes and its complications disrupt your everyday activities, the more likely it is to be recognized as a disability under the law.

Workplace Rights for People With Type 2 Diabetes

Protection Against Discrimination

Under the ADA, employers with 15 or more employees are prohibited from discriminating against people because of diabetes:

- You cannot be denied a job or promotion solely due to your diabetes.

- You are not legally required to tell your employer about your condition unless you request accommodations.

- Federally employed workers are also protected under the Rehabilitation Act.

Reasonable Accommodations at Work

If diabetes affects your job performance, you have the right to request reasonable accommodations. These modifications must help you manage your diabetes without imposing an undue hardship on the employer. Examples of reasonable accommodations include:

- Allowing the employee to keep food and diabetes supplies nearby

- Permitting breaks to check blood sugar, take insulin, or eat snacks

- Providing a private area for blood sugar monitoring or medication administration

- Allowing time off for medical treatment or recovery from complications

- Modifying work schedules or shifts

- Assigning tasks that do not require prolonged standing or walking if you have neuropathy

- Offering assistive devices for vision problems, like a large-screen monitor

Most accommodations are low-cost and cause minimal disruption in the workplace. Employers are obligated to work with you to find solutions. However, if an accommodation creates excessive expense or disruption, your employer may negotiate alternative options.

How to Request Accommodations

- Documentation: You may need a written note from your healthcare provider explaining why specific accommodations are necessary.

- Communication: Discuss your needs with your supervisor or human resources department.

- Individualization: Accommodations should be tailored to your unique needs and job requirements.

Disability Benefits: Applying With Type 2 Diabetes

Applying for disability benefits with type 2 diabetes requires comprehensive documentation of your condition and its impact on your life.

When to Apply

You may consider applying for disability benefits if:

- Diabetes complications prevent you from working or holding steady employment

- You experience severe symptoms despite following prescribed treatments

- Your health conditions meet or equal SSA’s listed impairments for other body systems (e.g., kidney disease, cardiovascular complications)

What You Need for Your Application

- Medical evidence, including doctor’s notes, test results, and hospital records

- Statements from healthcare providers about your functional limitations

- Information about any work accommodations you’ve needed

- Documentation of day-to-day activities and how they are impacted

- Testimony from family, coworkers, or supervisors if requested

Common Reasons for Denial

- The SSA determines that your diabetes is not severe enough to limit your ability to work

- You are not following recommended medical treatments without good cause

- Insufficient documentation of how complications limit your function

Consistently following your doctor’s advice and compiling thorough records increases your likelihood of approval.

Preparing for the Application Process

- Gather all medical documentation related to your diabetes and any complications.

- Document how diabetes affects your work and life (e.g., difficulties maintaining a work schedule, frequent hypoglycemia).

- Notify healthcare providers, family, and relevant coworkers that you will be applying, as they may be asked for supporting information.

Managing Diabetes in the Workplace

Balancing diabetes management and professional life can present unique challenges, but many tools and accommodations make it possible to maintain productivity and health.

Tips for Success at Work

- Keep glucose sources and testing supplies accessible

- Communicate with supervisors about your needs, especially if you anticipate emergencies

- Use scheduled breaks to manage blood sugar

- Educate trusted coworkers about the signs of severe hypoglycemia or what to do in an emergency

- Plan for flexibility in case of treatment adjustments, complications, or time off for appointments

Frequently Asked Questions (FAQs)

Is type 2 diabetes always considered a disability?

No, not in all cases. While type 2 diabetes is recognized as a disability under the ADA, eligibility for job accommodations or government benefits depends on how much the condition limits your daily activities and work. Most people with well-managed diabetes do not qualify for SSA disability benefits unless they experience major complications.

What rights do I have at work as someone with type 2 diabetes?

You are protected from discrimination, have the right to privacy, and can request reasonable accommodations. Employers must work with you to provide what you need—unless your requested changes pose an extreme hardship for the business.

Can I be fired or denied a job because of my diabetes?

No. The ADA prohibits employers from firing you, denying you a position, or treating you differently solely because of your diabetes.

Do I have to tell my employer about my diabetes?

Disclosure is voluntary unless you are requesting specific workplace accommodations or your diabetes could pose a safety risk in your job. Any medical information shared must be kept confidential.

How do I prove my diabetes is disabling for Social Security?

You must demonstrate that your diabetes and related complications substantially limit your functional abilities despite following treatment. Provide detailed medical records, physician statements, and records of how symptoms impact your work and daily life.

What workplace accommodations are commonly granted for diabetes?

- Flexible break times for blood sugar management

- Access to food and medication during the workday

- Private space for testing or treatment

- Time off for medical appointments

- Special seating or tasks if mobility is impaired

- Assistive technology for vision issues

What if my disability claim is denied?

You have a right to appeal any denial of benefits. Carefully review your paperwork, consult with your healthcare team to address any shortcomings, and consider getting legal assistance if needed.

Key Takeaways

- Type 2 diabetes can be considered a disability if it substantially limits your ability to work or perform daily activities, but a diagnosis alone does not guarantee benefit eligibility.

- The ADA protects against workplace discrimination and allows for reasonable accommodations.

- The SSA requires evidence of severe complications to approve disability benefits for type 2 diabetes.

- Comprehensive documentation and strict medical adherence are critical to receiving benefits or workplace accommodations.

- Employers are expected to work collaboratively with employees to provide support, fostering a more accessible and productive work environment.

Resources for Further Assistance

- American Diabetes Association (ADA): Advocacy, legal information, and educational materials

- Social Security Administration (SSA): Applications, guidelines, and appeals process for disability benefits

- Job Accommodation Network (JAN): Guidance on workplace accommodations and employee rights

- Local diabetes educators and healthcare providers: Personalized advice and documentation

References

- https://www.bezzyt2d.com/discover/managing-t2d/health-a-guide-to-disability-benefits-and-type-2-diabetes/

- https://www.healthline.com/health/type-2-diabetes/employee-rights

- https://www.pondlehocky.com/firm-news/giordano-provides-steps-with-healthline-for-those-with-type-2-diabetes/

- https://my.clevelandclinic.org/health/diseases/21501-type-2-diabetes

- https://www.healthline.com/health/video/type-2-diabetes

- https://www.healthline.com/health/video/diabetes-nutrition-101

- https://my.clevelandclinic.org/health/diseases/7104-diabetes

- https://californiahealthline.org/news/article/insulin-medi-cal-expands-patient-access-diabetes-supplies/

- https://www.healthlinedme.com/Resource-Center/Medical-Health-Issues?issue=Diabetes

Read full bio of Sneha Tete