Is Type 1 Diabetes Considered a Disability? Legal Protections, Accommodations, and Implications

Explore the classification of Type 1 diabetes as a disability, legal protections, rights at school and work, and practical accommodations.

Is Type 1 Diabetes Considered a Disability?

Type 1 diabetes (T1D) is more than just a medical diagnosis—it’s a chronic autoimmune condition that permanently impacts how individuals live, work, study, and interact in society. In the United States, under federal law, T1D is classified as a disability. This designation provides vital legal protections and rights, including access to reasonable accommodations at school, in the workplace, and in public spaces. Understanding the implications of this status is crucial for effective self-advocacy and ensuring an equitable environment for all affected by T1D.

Defining Disability: The Federal Perspective

The Centers for Disease Control and Prevention (CDC) states that a disability is a physical or mental health condition that limits a person’s movements, senses, or activities. Under this definition, diabetes is regarded as a protected disability under multiple federal statutes, specifically including both type 1 and type 2 diabetes.

- The Americans with Disabilities Act (ADA): Prohibits discrimination based on disability and ensures access to reasonable accommodations in public life, including jobs, schools, and public spaces.

- Section 504 of the Rehabilitation Act of 1973: Extends anti-discrimination provisions to programs and activities that receive federal financial assistance.

This recognition means that, regardless of individual perceptions or how well-managed the condition may be, the law guarantees certain rights and protections for all people with diabetes.

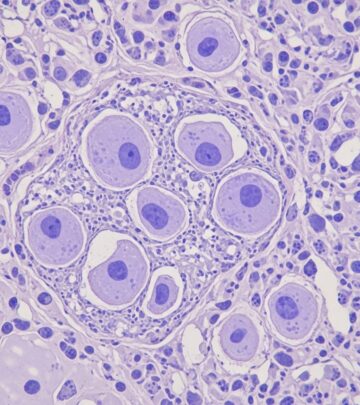

Why Is Type 1 Diabetes Classified as a Disability?

Type 1 diabetes fundamentally impairs the body’s endocrine system, preventing the natural production of insulin and requiring ongoing artificial regulation of blood sugar levels. Under federal law, any chronic condition that substantially limits the function of the endocrine system qualifies as a disability.

The legal basis for this classification rests on the following factors:

- Type 1 diabetes is a lifelong condition with no cure, requiring constant management.

- The disease can significantly limit daily activities, from meal planning and exercise to emergency handling and medication dosing.

- Even well-controlled T1D necessitates frequent medical attention, monitoring, and special accommodations.

This designation applies regardless of whether a person’s blood sugars or A1C levels are tightly managed; the requirement for ongoing vigilance and medical intervention is itself considered disabling in a legal context.

Legal Protections and Rights Under Federal Law

Federal law extends a range of legal protections and guarantees to individuals with T1D, including:

- Non-discrimination at school and work: Employers and educational institutions cannot lawfully deny opportunities or treat individuals with T1D unfairly based on their condition.

- Reasonable accommodations: Schools and employers must provide modified policies, programs, or physical environments as needed for diabetes management, as long as they do not impose undue hardship.

- Access to public places: Public venues—including recreation areas, restaurants, and government facilities—must not restrict or delay access to essential diabetes care tasks (e.g., taking insulin, consuming food or drink to treat hypoglycemia).

- Protection during interactions with law enforcement: Laws exist to ensure the safety and appropriate treatment of individuals with diabetes in legal and emergency scenarios.

Accommodations for People With Type 1 Diabetes

“Reasonable accommodations” may vary significantly based on individual needs and environments. The following are common examples of diabetes-related accommodations at school, work, and in public settings:

- Permission to eat or drink when needed (e.g., during meetings, exams, public transport rides)

- Time and designated spaces to check blood glucose levels or administer insulin

- Breaks to address glucose highs or lows

- Ability to carry and use diabetes supplies and medication at all times

- Flexibility around deadlines or schedules in response to medical emergencies or appointments

The process for requesting accommodations typically involves written communication (sometimes formal documentation), a clear explanation of needs, and a collaborative dialog between the individual and the school or employer.

Children With Type 1 Diabetes: School Rights and Protections

Legal protections for children with T1D are robust and begin at a young age, as disability rights are not age-restricted. In public schools, the 504 plan is a principal tool for ensuring a safe, supportive, and equitable educational environment for students with diabetes.

- A 504 plan is a written agreement developed between families and schools.

- It specifies necessary accommodations, such as permission for blood glucose monitoring, insulin administration, or absence flexibility for doctor’s visits.

- Schools must implement the plan to maintain student safety and academic access.

Families can consult local diabetes educators or organizations, such as the American Diabetes Association, for guidance and access to sample 504 plans.

Type 1 Diabetes and Disability Benefits

While T1D is classified as a disability for legal protections, qualification for government disability benefits—like those provided by the Social Security Administration (SSA)—is more stringent.

- Simply having T1D does not automatically qualify individuals for financial disability benefits.

- The SSA defines disability as the inability to engage in substantial gainful activity due to medically determinable impairments expected to last at least 12 months or result in death.

- Individuals must demonstrate that diabetes or its complications make it impossible to maintain work, despite reasonable accommodations.

- Medical documentation, work history, and evidence of functional limitations are required during the application process.

The process is complex, and applicants may benefit from specialized legal or advocacy support, especially if applications are denied initially.

Common Health Complications and Why Some People Need Disability Accommodations

Type 1 diabetes is not always outwardly visible (sometimes called an “invisible disability”), but it can produce severe complications that warrant additional accommodations and protections:

- Eye disease (such as retinopathy, swelling, or fluid fluctuations)

- Foot problems (nerve damage, poor circulation, ulcers)

- Heart disease or stroke

- Kidney disease

- Nerve damage (neuropathy, affecting pain sensation and autonomic control)

- Gum and skin issues (increased infections, slow-healing wounds)

- Bladder or sexual dysfunction (poor blood flow or nerve supply)

These complications may (“qualify separately as disabilities and be considered in shaping accommodations”), and they can further compromise safety, independence, and ability to work or study. Addressing both the underlying diabetes and its related complications is an important part of effective advocacy.

Tax Credits and Financial Support

People with T1D may be eligible for certain tax credits or deductions associated with the costs of disease management. Common qualifying expenses can include:

- Glucose monitoring supplies and insulin

- Diabetes-related medical devices (e.g., continuous glucose monitors, insulin pumps)

- Doctor appointments, prescriptions, and emergency management kits

- Transportation costs for medical care

Consult a tax professional or financial advisor to learn more about possible tax benefits, as provisions vary by location and circumstance.

Workplace Protections for Employees With Type 1 Diabetes

Employees with T1D have the right to safe and equitable treatment in the workplace. Under the ADA and related laws:

- Employers are required to make reasonable adjustments to schedules or duties to allow for blood sugar checks, breaks, meal times, or medical appointments.

- It is illegal to refuse employment, promotions, or reasonable support to someone solely because they live with T1D.

- Employers cannot retaliate or penalize workers for requesting accommodations or for absences related to diabetes care.

If workplace challenges occur, employees may consult human resources, ADA coordinators, or legal specialists.

Job Restrictions Related to Type 1 Diabetes

Despite protections, certain occupations may have specific requirements or restrictions tied to public safety. Examples include:

- Pilots, commercial drivers, or emergency responders, where sudden incapacitation from hypoglycemia poses a safety risk to others.

- Military service, which has its own set of health criteria and medical waivers.

These restrictions do not negate all employment opportunities; instead, they recognize risks unique to certain high-responsibility roles. In most cases, employers and regulatory agencies must conduct individualized assessments before making determinations about job placement.

Frequently Asked Questions (FAQs)

Is Type 1 diabetes always considered a disability?

Yes, under federal law, type 1 diabetes is classified as a disability, regardless of how well-managed the condition is.

Do children with T1D qualify for school accommodations?

Yes. Children with T1D are protected by law and are eligible for accommodations, typically through a 504 plan in public schools.

Can I lose my job due to type 1 diabetes?

No. Employers cannot terminate or discriminate against employees based on their diabetes status, as long as job performance is maintained with reasonable accommodations.

Is type 1 diabetes enough to get government disability benefits?

Not automatically. You must show, with adequate documentation, that diabetes or associated complications severely and persistently prevent you from working full-time, even with accommodations.

What should I do if my rights are violated due to my diabetes?

First, try to resolve the issue through school or workplace channels. If unresolved, file a formal complaint with the Office for Civil Rights, Equal Employment Opportunity Commission, or seek legal assistance specializing in disability rights.

Further Resources

- American Diabetes Association: Guidance and advocacy

- ADA regulations: Official documentation on diabetes accommodations

- Social Security Administration: Disability evaluation and benefits procedures

- Local diabetes educators: Personalized advice for accommodation planning

References

- https://disabilityadvice.org/qualifying-conditions/diabetes/

- https://www.healthline.com/health/diabetes/is-type-1-diabetes-a-disability

- https://sslg.com/are-type-1-diabetics-eligible-for-disability-benefits/

- https://www.medicalnewstoday.com/articles/is-type-1-diabetes-a-disability

- https://myphiladelphiadisabilitylawyer.com/disabling-conditions/diabetes/

- https://diabetes.org/advocacy/know-your-rights/is-diabetes-a-disability

- https://diabetes.org/advocacy/attorney-resources/proving-diabetes-is-a-disability

- https://www.ssa.gov/disability/professionals/bluebook/109.00-Endocrine-Childhood.htm

- https://www.myt1dteam.com/resources/disability-benefits-for-type-1-diabetes-the-steps-you-need-to-take

- https://www.ssa.gov/OP_Home/rulings/di/01/SSR2014-02-di-01.html

Read full bio of Sneha Tete