Affording Chronic Kidney Disease (CKD) Treatment: Navigating Costs, Insurance, and Resources

Managing CKD treatment expenses is complex, but knowing your insurance options, available assistance, and financial planning strategies can make a significant difference.

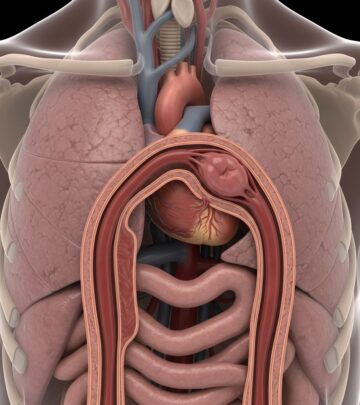

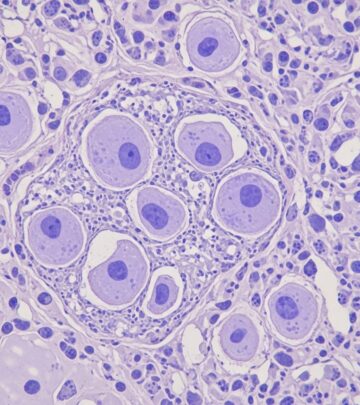

Chronic kidney disease (CKD) is a progressive, lifelong condition that requires careful medical management and often leads to substantial healthcare costs. From frequent doctor visits and medications to dialysis or kidney transplantation, the financial implications can be overwhelming. In this guide, we explore the costs associated with CKD, the complexities of insurance coverage, available assistance programs, and practical steps you can take to manage your expenses.

Why CKD Treatment Costs Add Up

CKD is not just one disease—it’s a spectrum, ranging from mild impairment to total kidney failure. The cost of care increases as the disease progresses. People with more advanced CKD or kidney failure require expensive treatments like dialysis or transplant, along with frequent monitoring and management of related health issues, such as high blood pressure or diabetes.

- Routine monitoring: Regular blood and urine tests, office visits, and imaging.

- Medications: Medicines for CKD and related conditions (e.g., blood pressure, anemia, bone health).

- Treatments: Dialysis or kidney transplant for advanced CKD.

- Hidden costs: Transportation, lost wages, home care, and special diets.

Out-of-pocket expenses can mount even if you have insurance, particularly for high-cost treatments like dialysis or medications not fully covered by your plan.

Breaking Down the Costs of CKD Care

Medical Costs by Treatment Type and CKD Stage

| Treatment/Stage | Average Annual Cost (USD) | Notes |

|---|---|---|

| Early-stage CKD (G3a) | $3,060 | Primarily medical monitoring & medications |

| Hemodialysis(center-based) | $57,334 | Three sessions per week typical |

| Peritoneal Dialysis | $49,490 | Usually done at home |

| Kidney Transplant (Year 1) | $75,326 | Surgery, hospital stay, immunosuppressant drugs |

| Kidney Transplant (Annual maintenance after Year 1) | $16,672 | Ongoing medication and monitoring |

These are sample averages. Actual expenses vary widely based on location, hospital, insurance type, specific treatments, and related health needs. The costs for complications like heart attacks or strokes can be substantial, compounding CKD’s financial burden.

The Hidden Costs: Beyond Medical Bills

Insurance often doesn’t cover every expense related to CKD treatment. Out-of-pocket costs to consider include:

- Transportation: Frequent trips to clinics and dialysis centers

- Lost income: Time away from work for appointments or illness

- Caregiving: Home healthcare, family support, or paid caregivers

- Special diet needs: Low-sodium, low-potassium, or protein-modified foods

Many CKD patients also experience financial toxicity—stress and hardship caused by overwhelming health expenses, which can negatively affect wellbeing and even treatment adherence.

Understanding Health Insurance Coverage for CKD

Health insurance is essential for managing CKD costs, but coverage varies by plan and provider. Learning the basics about insurance types and common pitfalls can help you avoid surprise bills and maximize reimbursement.

Types of Health Insurance

- Private/Employer-sponsored Insurance: Covers a portion of medical costs for those who are employed or their dependents.

- Marketplace Insurance: Plans purchased via healthcare.gov or state marketplaces, often with subsidies based on income.

- Medicare: Federal insurance primarily for those age 65 or older, or under 65 with certain disabilities—including most people needing dialysis or kidney transplant.

- Medicaid: State-federal insurance for people with limited income or resources. Eligibility rules and benefits differ by state.

- Children’s Health Insurance Program (CHIP): Low-cost coverage for children in families that earn too much for Medicaid but can’t afford private insurance.

Key Things to Know About Coverage

- Most health insurance plans—including Medicare and Medicaid—cover major CKD treatments, such as dialysis and kidney transplantation.

- Medicare covers 80% of treatment costs for dialysis and transplantation after deductibles. You will still be responsible for the remaining 20% unless you have supplemental coverage.

- Some policies have out-of-pocket maximums. After reaching this limit, the plan pays 100% of covered in-network care for the remainder of the year.

- Prescription drug coverage (Medicare Part D or private plans) is crucial for covering the cost of CKD-related medications, especially expensive immunosuppressive drugs post-transplant.

- Not all health plans pay for every doctor, hospital, or treatment. Check networks, formularies, and pre-authorization rules before starting any new therapy.

Common CKD Insurance Challenges

- Denials or delays for coverage, especially for expensive new drugs or specific types of dialysis

- Unexpected out-of-network charges

- Annual or lifetime coverage caps (rare with current law, but can affect some legacy private plans)

- Confusion over coordination of benefits if covered by multiple insurance policies

Getting Covered: Medicare, Medicaid, and Marketplace Plans

Medicare for CKD

Medicare is the primary payer for most Americans with end-stage renal disease (ESRD) who need dialysis or kidney transplantation, regardless of age. Here’s what you should know:

- You qualify for Medicare if you need regular dialysis or have had a kidney transplant, even if you are under 65.

- Coverage typically begins on the first day of the fourth month of dialysis. If you participate in home dialysis training, it may begin sooner.

- Medicare Part A covers hospitalizations; Part B covers outpatient care (including dialysis); Part D covers most prescription medications.

- Medicare Advantage (Part C) plans may offer additional benefits like vision, hearing, dental, and out-of-pocket maximums.

- Medicare pays 80% of covered dialysis costs. Private or supplemental insurance may cover the remaining 20%.

Medicaid

Medicaid provides free or low-cost coverage based on household income and size. Many people with CKD qualify for both Medicare and Medicaid (“dual eligible”), which can significantly reduce out-of-pocket expenses. Medicaid also covers additional services not included in Medicare, such as social support services, transportation, and long-term care in some settings.

Marketplace (ACA/Obamacare) Plans

- CKD (and other pre-existing conditions) must be covered by all ACA-compliant marketplace plans.

- Premium subsidies and cost-sharing reductions are available for individuals and families with limited incomes.

- Carefully check plan networks for nephrologists, dialysis centers, and transplant programs before enrolling.

Financial Assistance Programs and Support Resources

Even with insurance, many people with CKD face high out-of-pocket costs for premiums, deductibles, copayments, and non-covered services. Numerous programs exist to fill these gaps.

Patient Advocacy and Assistance Organizations

- American Kidney Fund (AKF): Provides grants to help low-income dialysis and transplant patients with insurance premiums and other expenses.

- National Kidney Foundation (NKF): Offers education, advocacy, and referral to local financial assistance programs.

- Kidney Care Partners and State Renal Programs: Some states offer financial assistance for in-center dialysis, medications, transportation, or temporary housing near transplant centers.

Hospital and Dialysis Center Financial Counselors

- Most large hospitals and dialysis providers have financial coordinators who can:

- Help you apply for Medicaid, supplemental coverage, or pharmaceutical assistance programs

- Assist with charity care applications and sliding fee discounts based on your ability to pay

- Explain billing, uncovered services, and strategies for minimizing out-of-pocket losses

Drug Assistance Programs

- Pharmaceutical companies’ patient assistance programs may discount or provide free medications to uninsured or underinsured patients.

- Non-profit foundations grant copay or premium assistance for high-cost medications (especially for those on long-term immunosuppressive therapy post-transplant).

Government and Nonprofit Support

- Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI): If CKD impairs your ability to work, you may qualify for cash benefits that also help qualify you for Medicaid.

- State health insurance counseling programs (SHIP): SHIP counselors provide free, unbiased help understanding Medicare and Medicaid options, appeals, and low-income assistance.

Tips to Keep CKD Expenses Under Control

- Review your insurance plan every year during open enrollment to confirm that your doctors, dialysis clinic, and nearest pharmacy are in-network.

- Track all out-of-pocket medical costs including premiums, copays, and transportation, as receipts can help qualify for assistance programs or tax deductions.

- Use generic or covered alternative medications whenever possible to reduce pharmacy costs.

- Ask about financial aid early—reach out to social workers, financial counselors, or nonprofit groups as soon as you anticipate a large expense or change in coverage.

- Appeal denied claims and ask for insurance exceptions when treatments are medically necessary.

- Stay informed about legislative changes affecting CKD coverage and assistance resources.

Frequently Asked Questions (FAQs)

How much does dialysis cost if I have Medicare?

Medicare pays about 80% of covered dialysis costs after deductibles. In 2025, the base Medicare-approved rate is $273.82 per hemodialysis session. However, most people pay less out-of-pocket if they have supplemental coverage such as Medicaid, Medigap, or employer insurance. Private insurance plans often pay more per session.

Am I eligible for Medicare before age 65 if I have kidney disease?

Yes, if you have end-stage renal disease (ESRD) requiring regular dialysis or if you have a kidney transplant, you are eligible for Medicare regardless of your age.

Are there financial help programs for CKD patients without insurance?

Yes. The American Kidney Fund, National Kidney Foundation, and various state and local programs offer grants and practical help for premiums, transportation, and other costs. Hospitals and dialysis centers also have financial counselors who can help identify assistance options.

Can I work while on dialysis or after a kidney transplant?

Many people continue to work, especially with at-home dialysis, flexible scheduling, or after successful transplant recovery. Some qualify for short-term or long-term disability benefits if CKD limits their ability to work.

What can I do if I can’t afford my medications?

Ask your doctor or pharmacist about generic options. Apply to manufacturer assistance programs or charity organizations. Check Medicaid or state prescription assistance. Social workers can direct you to local and national programs tailored to CKD medications.

Resources and Support for Affording CKD Care

- American Kidney Fund (AKF): Financial aid and patient support

- National Kidney Foundation (NKF): Education, advocacy, and referrals

- Dialysis center and hospital social workers: Personalized financial counseling

- Medicare Official Site: Eligibility and coverage details

- Healthcare marketplace: Marketplace insurance information

Careful planning, knowing your benefits, and reaching out to advocacy organizations can make CKD treatment costs far more manageable. Don’t hesitate to seek help—many resources are available to ensure you get the care you need without overwhelming financial stress.

References

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10499937/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC6452586/

- https://www.healthline.com/health/kidney-disease/hemodialysis-vs-peritoneal-dialysis

- https://www.medicalnewstoday.com/articles/172179

- https://www.healthline.com/health/video/foods-to-avoid-with-kidney-disease

- https://www.ethosbiosciences.com/the-cost-of-chronic-kidney-disease-ckd

- https://www.youtube.com/watch?v=XUnRopZmYJs

Read full bio of Sneha Tete